Going Circular: Seize the opportunity in plastic recycling

Thanks to its versatility, plastic has become an indispensable part of our everyday world, offering customized solutions to a wide variety of products, applications and sectors.

However, its popularity and versatility has also created a major global crisis: plastic waste.

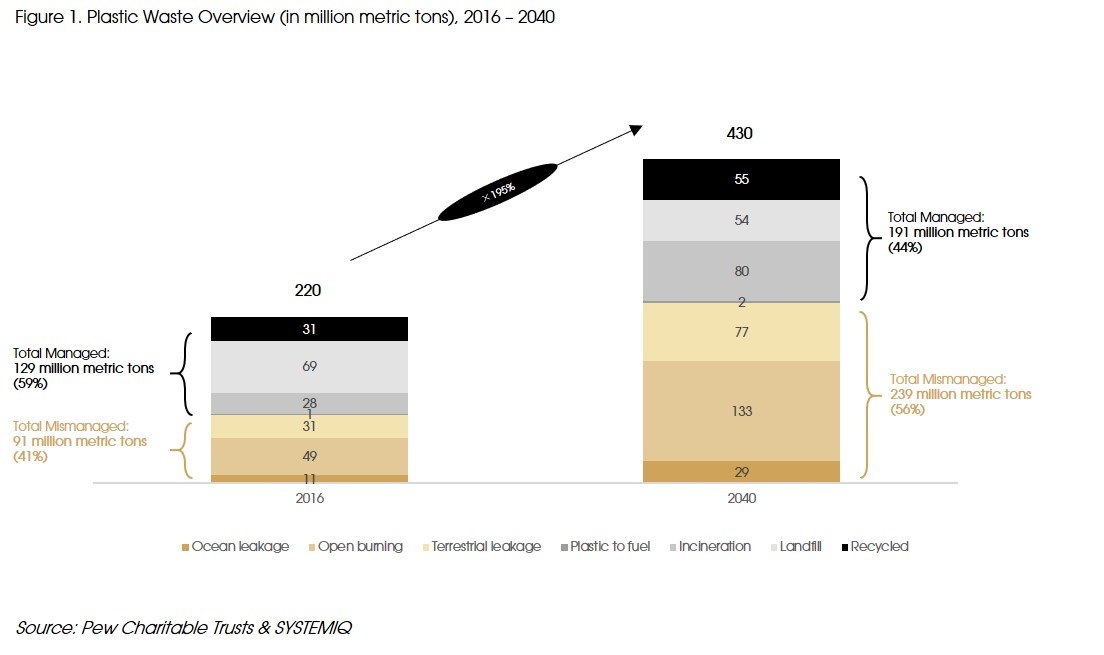

According to Pew Charitable Trusts & SYSTEMIQ, mismanaged plastic waste will grow from 91 million metric tons in 2016 to 239 million metric tons by 2040. Plastic waste flows into the oceans are projected to nearly triple by 2040 to 29 million metric tons per year. Even worse, the cumulative amount of plastic stock in the oceans could grow by 450 million metric tons in the next 20 years — with severe impact on biodiversity and human health. At this rate, plastic is expected to outweigh all the fish in the ocean by 2050, according to the United Nations.

95 percent of plastic packaging is lost after a single use cycle because of a structurally flawed linear value chain system based on “take, make and dispose”. In addition, many markets lack the capability and capacity to collect, sort and treat plastic waste economically after its use.

Recycling aims to change this model by re-integrating materials back into the value chain, creating a loop instead of the linear model, therefore reducing the need for new materials, while re-using materials already in the system.

The increased public concern on plastic pollution has led to many countries to promote recycling, implement stringent regulations on plastic waste disposal and raise awareness on the importance of plastic recycling. Europe is a forerunner in this sector for its supportive regulatory environment. The latest Circular Economy Package adopted by EU requires 55 percent of plastic packaging waste to be recycled by 2030 (compared to 41 percent in 2016) and a ban on landfilling of separately collected waste. Asia has also been realizing the importance of sustainability. China has taken strong measures, banning the import of plastic waste in 2017, after being the world’s largest importer foreign plastic waste, in a drive to reduce the amount of its plastic waste. Recently, China has also made an ambitious pledge to the world that the country would reach peak emission by 2030 and become carbon neutral by 2060, which requires to shift China’s economy fundamentally away from fossil fuels. In this case, Chinese government will be more focusing its efforts on those carbon and fossil intensive sectors such as plastic production, potentially leading to a boost in its plastic recycling industry.

From the industry perspective, several consumer giants and industry players like IKEA, P&G and NIKE use recycled instead of oil-based plastics and have pivoted their supply chain to have recycling central to their value proposition.

Current challenges for plastic recycling

However, even with initiatives from both governments and industry, penetration of recycled plastic in the value chain remains low. Currently 20 percent of plastic enters recycling systems and, after accounting for sorting and losses, only 15 percent of global plastic waste is actually being recycled.

In order to further develop and scale up plastic recycling, there are still significant barriers to be considered and tackled.

I. The Economic Challenge:

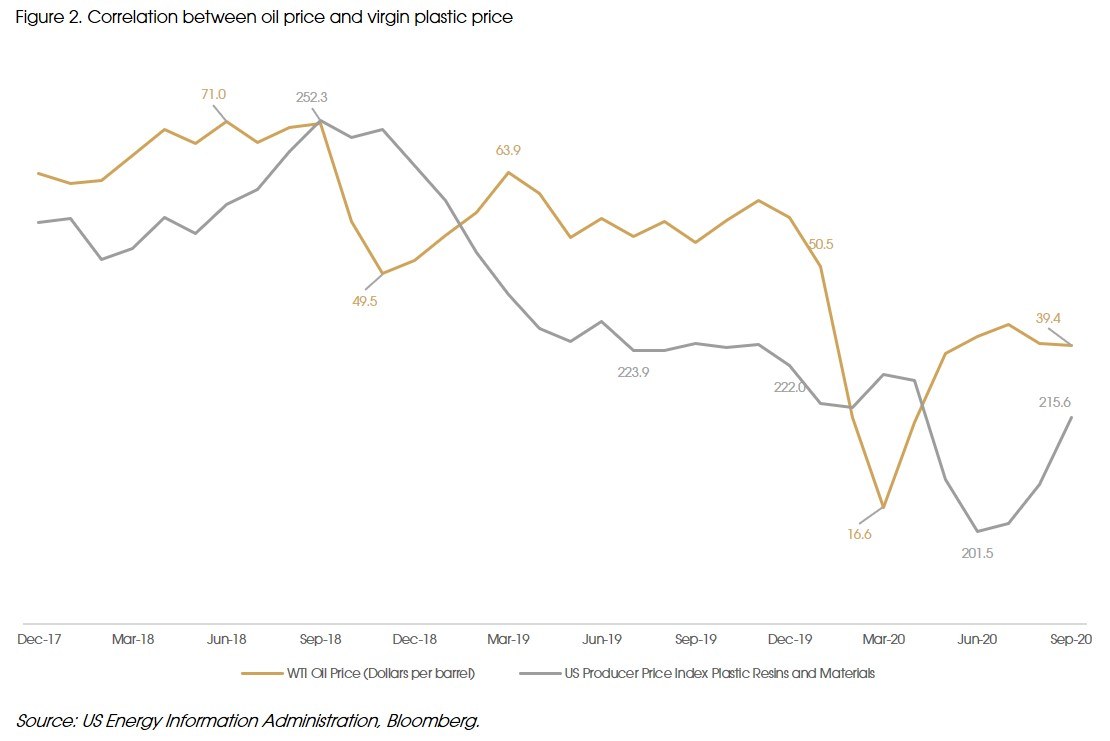

The price of plastic (both virgin and recycled) is strongly correlated with the oil price. Currently, due to the coronavirus pandemic, the market has even seen a historically low price for crude oil, which also dragged down the price of virgin plastics and further squeezing the margin of recycled plastic.

II. The Supply Chain Challenges:

Supply Chain challenges stem from the lack of standardisation within the collection, separation and sorting system, the quality of the feedstock as well as the highly fragmented market of plastic recyclers, leading to lower recycling rates.

• The lack of standardization across the industry from the collection, separation and sorting increases the cost of sourcing due to different collection schemes, poor waste management systems and lack of consumer awareness or knowledge on how to separate plastics products properly. It leads to increased costs for recyclers to manage each different process, increasing the cost of the end product.

• Plastic recycling heavily depends on the quality of feedstock, with recyclers usually seeking plastic waste scraps with specific criteria, and focusing on the lowest hanging fruit first for the best sources of quality feedstock, leading to large volatility in prices for plastic waste.

• The global landscape of plastic recyclers is highly fragmented featuring a large number of small and unstructured players, leading to fierce competition and low market efficiency. Furthermore, buyers are also faced with the burden of testing potential sources of recycled plastic for additives, density, melt flow and contamination on their own. All of these make the supply chain problem quite complicated.

III. The Technical Challenge:

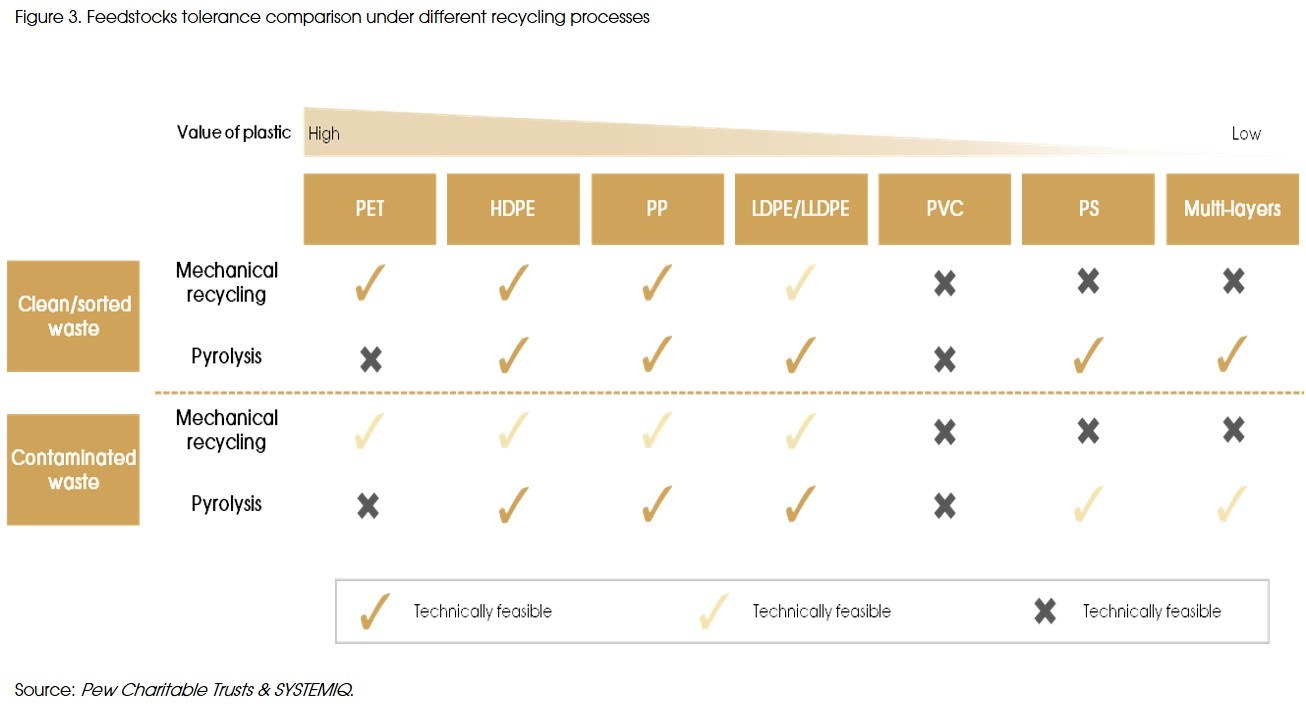

The complexity of resins and diversity of plastic products design often impose difficulties in recycling process. Most of time plastic products are made by composite or multilayer designs of different materials or polymer types under different process. In addition, different chemical additives and dyes enter the picture in order to give the plastic specific characteristics such as colour, shape, texture and so on. Consequently, there turns out to be thousands of variations of plastics and not all types of plastic can be recycled, making it more complicated and challenging to recycle from technology perspective.

IV. The Health Challenge:

The health and safety concerns regarding the usage of recycled plastic are rising, particularly in food-contact applications, as plastics might be contaminated by the substances that they held, therefore leading to accumulation of hazardous chemicals in recycled material. Consequently, regulations exist in quite a few jurisdictions specifically addressing the safety of recycling processes and materials.

The European Food Safety Authority (EFSA) strictly regulates the use of recycled plastics in food packaging and establishes the authorization procedures for substances used in food contact materials, with the EFSA assessing the applications submitted for authorization purposes.

Investment Trends in plastic recycling sector

Though some uncertainty remains around scaling up of plastics recycling businesses, investments in innovative solutions in this sector remains relevant. From the M&A and funding perspective, several interesting trends have been identified:

I. Chemical recycling becomes a hot topic

Mechanical recycling is the predominant way of recycling plastic, but it is limited by several factors: the quality of the feedstock, the limitation to mechanically recycled composite plastics profitably and carbon footprint to recycle plastic up to the quality of virgin plastics.

Therefore, as a complementary process, chemical recycling becomes more and more critical.

Chemical recycling technology is still in its early stage of development that have not yet reached commercial viability and economic scale. Therefore, significant capital flows are expected to finance the technology development and infrastructure construction in the chemical recycling sector, with more M&A opportunities to develop as companies looking for opportunities to acquire innovative capabilities.

Since early 2019, several industry players have announced new plans for chemical recycling. BASF is one of them, which launched a project called ChemCyclingTM in 2018 with the aim of manufacturing products from chemically recycled plastic waste on an industrial scale. It has cooperated with technology partners Quantafuel and Pyrum who use a thermochemical process called pyrolysis to transform plastic waste into secondary raw material.

II. Chemical groups have been playing an increasingly important and active role in the consolidation of the plastic recycling sector

In light of the growing regulatory and public pressure with regards to recyclability, plastic recyclers have become attractive targets for both strategic and financial investors, especially for those chemical giants. Considering their urgent need to accelerate the process of transformation and the highly fragmented nature of plastic recycling, M&A is always the fastest route to gain access to advanced technology and secure sufficient access to waste-plastics feedstock supply.

There have been some recent acquisitions of plastics-recycling companies in Europe by major petrochemical companies, a trend likely to continue. Tokyo-based Mitsubishi Chemical Corp has announced to acquire two Swiss engineering plastics recyclers, Minger Kunststofftechnik AG and Minger Plastic AG, prompted by the company’s mission to promote the circular economy, in order to establish an integrate business model from manufacturing to sales, collection, recycle and reuse.

III. Digitalization of plastic scrap supply chain

With the growing amount of plastic waste and booming demand for recycled plastic, low efficiency of the supply chain has become a pain point.

As mentioned above, the current recycled plastic supply chain is a slow process with scattered players and little standardization. People are struggling to find a way to better connect the waste management system, plastic recyclers and manufacturers worldwide to streamline the procurement process.

Therefore, those promising technologies that could better bringing supply chain digitally together and enable greater cooperation amongst all key players are sure to attract more significant interests and funding.

One great example is the innovative French circular economy start-up Polytopoly.com, which just finished its second angel round in March 2020. It is engaged in building a reliable network of nearly 300 European polymer recyclers to consolidate the procurement process. Thanks to its certified laboratories, all of the recycled polymers are analysed and tested to strict safety and quality standards to ensure the highest excellence in future production. By having complete insight into the quality of materials listed, Polytopoly.com can easily match specific manufacturer requirements such as grade, price, quantity, quality, and characteristics to the various solutions available from different recyclers.

Conclusion

In conclusion, creating a circular economy is the solution to an increasingly serious plastic pollution problem and growing pressure from the public. Governments and major industry players are continuously discussing and refining targets to reduce waste and improve the circularity of the plastics value chain.

Although current recycling efforts are facing several headwinds, especially under an increasingly complex landscape buffeted by COVID-19, the pressure to adapt to sustainability and ever-evolving public expectations is here to stay. The sector now is witnessing a strong trend of consolidation along the value chain and various investment opportunities are springing up. Players who could respond quickly and decisively will drastically increase their chances of remaining competitive in the years to come.

From the perspective of cross-border transactions, considering Asian countries’ increasing awareness and shifting focus on sustainability, European recyclers might become interesting targets for Asian players to acquire capabilities and accelerate growth. On the other way, Asia would also be a popular destination for European investors given its huge market potential in the foreseeable future. CIGP, is thus well positioned as a bridge between Asia and Europe, leveraging its European DNA, strong Asian presence as well as proven track record in plastic recycling sector.

Appendix

[1] Breaking the plastic wave, Pew Charitable Trusts & SYSTEMIQ, 2020;

[2] US Energy Information Administration;

[3] Bloomberg;

[4] Recycling Plastics: Complications & Limitations, Eureka Recycling;

[5] Closing the Loop on the Plastics Dilemma - Proceedings of a Workshop–in Brief, National Academies of Sciences, Engineering, and Medicine, 2020;

[6] No time to waste: What plastics recycling could offer, McKinsey, 2018;

[7] The New Plastics Economy, World Economic Forum, 2016;

[8] Blueprint for plastics packaging waste: Quality sorting & recycling, Deloitte, 2017;

[9] The plastic recycling opportunity, KPMG, 2019;

[10] Functional Barriers for the Use of Recycled Plastics in Multi-layer Food packaging, Packaging Europe, 17 May 2017.